Introduction

A startup is a word that has been heard a lot in the IT community in recent years, but what is a startup? Commonly, it is mainly technology startups that develop various applications or services, but also security software that is used by people and countries around the world. Often we don’t even know that a commonly used application was previously a startup. An example is the Uber app. The company was originally a startup and raised USD 11 million in Series A in 2011. Such startups then often stir up the stagnant entrepreneurial waters and create something new, and the whole of human society benefits.

The term startup

So what is actually behind the term startup? Defining a startup is not easy. It is important to mention that the term is not translated and therefore the English term startup is used. According to Management Mania (2016), the term has become widely used especially during the development of the so-called dot-com companies[1] and defines startup as follows: “Startup (also start up, start-up, startup company) is a term referring to an emerging project or start-up that is innovative and has a high potential for growth.” This definition makes it quite clear that it is a company that is just starting out, so it is not an established company, and at the same time, it has a large growth potential, which is one of the main factors that distinguishes startups from other companies that are also starting out with some business intent but do not expect or have such a large growth potential. Paul Graham (2012), a well-known investor and founder of the Y Combinator[2] accelerator, defines a startup primarily as a company that is designed to grow rapidly. He does not consider every newly founded company to be a startup. He takes it as a basic assumption that such a newly founded company must first of all grow fast. Importantly, he also mentions the irrelevance of whether the startup is working with technology, has received venture[3]investment, or whether the startup will have an exit at the end[4]. The only thing that matters is the growth itself and that is what Graham associates everything related to startups with. To complete the whole idea of growth, Andrej Kiska (2015), a partner at Credo Ventures, describes a startup based on Paul Graham as a company that does not necessarily achieve its growth ambitions, but is totally committed to that goal and operates accordingly. This, according to Kiska, leads to a change in the mindset of the founders of such a company, where they are more concerned with how to achieve the goal instead of the status quo.

From the above definitions, it follows that a startup is a newly founded company, which is mostly, but not as a rule, dedicated to working with technology and trying to bring to the market some new solution that should be revolutionary and ensure this business company’s so-called meteoric growth, where this growth ambition is the main determining factor whether it is a startup company. But for a company to achieve meteoric growth two factors need to be followed. Both of these factors are money. In layman’s terms, one factor determines how much money “flows out” of the company and the other determines how much money “flows in”. The issue here is how much money a startup gets from investors to grow in a dizzying way, because it’s not just the mind of the individual founders that has something to do with such big growth, but marketing and other big expense items also contribute a large part. For completeness, below, in the context of the investments mentioned, is what the investment cycle looks like for a startup and what the different stages entail and how investors approach them.

Stages of the investment cycle

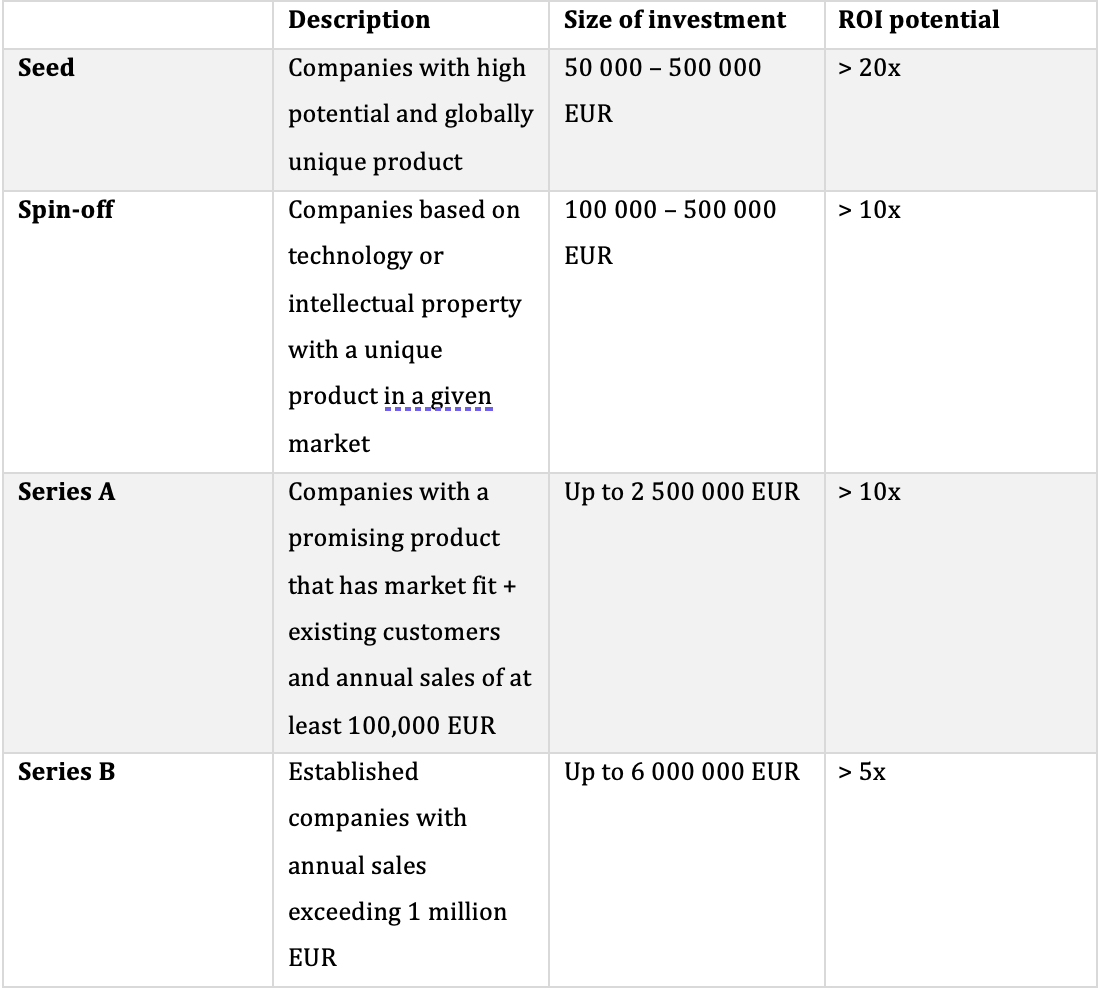

The first phase of the investment cycle is called Seed and it is the second most risky period of a startup, as stated by Management Mania (2016) with each successive phase the risk decreases, the amount invested increases and the return to the investor also decreases. Since the company is holding nothing but its idea that it has started to implement and the product will only appear in a few weeks to months and the time when the new product will be on the market is still very far away, it is quite risky for the investor to invest describes Kiska. However, should investors decide to back the project, a lower investment, as shown in the table below, should be expected, along with a larger expected surrendered stake in the company to the investors.

The spin-off period, according to Management Mania (2016), refers to specific companies that have been created based on some intellectual property and are usually founded by large corporations.

The Series A phase is the first major phase where the company’s product is already on the market and a baseline year-on-year turnover is generated. Kiska (2015) reports that investors have no problem investing millions in such a company, as seen in the table below.

The last standard stage is Series B when the company is already known in the market and invests in further expansion (Management Mania 2016). The risk for such an investment is relatively low for investors and therefore they invest high amounts (Kiska 2015).

There are other phases that continue with letters in the alphabet. Normally, startups do not get beyond Series F. However, as Paul Graham (2012) writes, most startups start making money after a few years at best, and some never do.

In addition to the stage below, there is a “zero” investment stage, called Angel investment, where the investor comes in as an angel investor who invests in the founders’ idea.

Summary

In this rapidly changing technology landscape, startups play an integral role by innovating and bringing groundbreaking solutions to the market. Defined not by their affiliation with technology or venture investment, startups are characterized by their aspiration for swift, significant growth, a trait often reflected in their operations and the mindset of their founders.

Sources:

- GRAHAM, Paul, 2012. Startup = Growth. Paul Graham [online]. Velká Británie: Paul Graham, 2012 [cit. 2023–07–31]. Available from: http://paulgraham.com/growth.html

- KAGAN, Julia, 2020. Dotcom. Investopedia [online]. New York: Investopedia [cit. 2023–07–31]. Available from: https://www.investopedia.com/terms/d/dotcom.asp

- KISKA JR., Andrej, 2015. Central European Startup Guide. Credo Ventures.

- Startup, 2016. ManagementMania.com [online]. Wilmington: ManagementMania.com [cit. 2021–01–09]. Available from: https://managementmania.com/cs/startup

- Venture kapitál, rizikový kapitál (Venture Capital), 2017. ManagementMania.com [online]. Wilmington: ManagementMania.com [cit. 2023–07–31]. Available from: https://managementmania.com/cs/venture-capital

- Bachelor’s thesis by the author of the article

[1] According to Investopedia (2020), a dot-com or dotcom is a company that operates its business primarily on the Internet. The Internet thus becomes a key element for the company’s business. They are so-called by the .com domain. Most of the biggest startups in the last 20 years have been dot-com companies.

[2] Y Combinator is an influential startup accelerator and startup investment company.

[3] According to Management Mania (2017), Venture capital, or venture capital, refers to capital invested in building businesses, i.e., it is capital that must be invested in starting a business, getting the business off the ground, and developing other businesses. This form of capital can be invested by individuals, private persons as well as specialised companies. For example, it could be an angel investor, who is usually a former entrepreneur and invests his or her own money in the early stages of a project. Another type of investor is a Venture Capital Fund, which is a company that pools funds from different investors and makes investment decisions on their behalf. The last option may be a government-established organization or fund. So this is the type of capital that is invested primarily in startups.

[4] According to Management Mania (2016), exit refers to a planned departure or exit from the company. “It is most commonly used to refer to the sale of a stake in a company.” It is therefore a pre-planned decision to leave the company for profit. In an exit, the investor sells his stake to another investor or other interested parties. Alternatively, the company may go public. The exit takes place normally within 2–5 years. The goal of a venture capital investor is to make a profit, which he plans to do through an exit, which is effectively a sale of the stake in the company.